Wendy Moniz's Net Worth refers to the monetary value of all her assets, including cash, property, and investments, minus any liabilities, such as debts and loans. For instance, if Wendy Moniz has assets worth $5 million and liabilities of $1 million, her net worth would be $4 million.

Understanding a celebrity's net worth is relevant as it provides insights into their financial success and earning potential. It can also be an indicator of their lifestyle, investing acumen, and overall financial well-being. Historically, celebrities have leveraged their net worth to make impactful investments, support charitable causes, and secure financial stability.

This article delves into the details of Wendy Moniz's net worth, exploring its components, origins, and its significance in the entertainment industry.

Wendy Moniz's Net Worth

Understanding the key aspects of Wendy Moniz's net worth provides insights into her financial success, lifestyle, and overall well-being.

- Assets: Properties, investments, cash

- Liabilities: Debts, loans

- Income: Earnings from acting, endorsements

- Investments: Stocks, bonds, real estate

- Expenses: Lifestyle costs, taxes

- Financial Management: Strategies for wealth preservation

- Career Success: Impact on net worth

- Personal Factors: Family support, lifestyle choices

These aspects are interconnected and influence Wendy Moniz's net worth. For instance, her income from acting contributes to her assets, while her expenses impact her overall financial picture. Understanding these dynamics provides a comprehensive view of her financial standing.

| Name | Birth Date | Birth Place | Occupation |

|---|---|---|---|

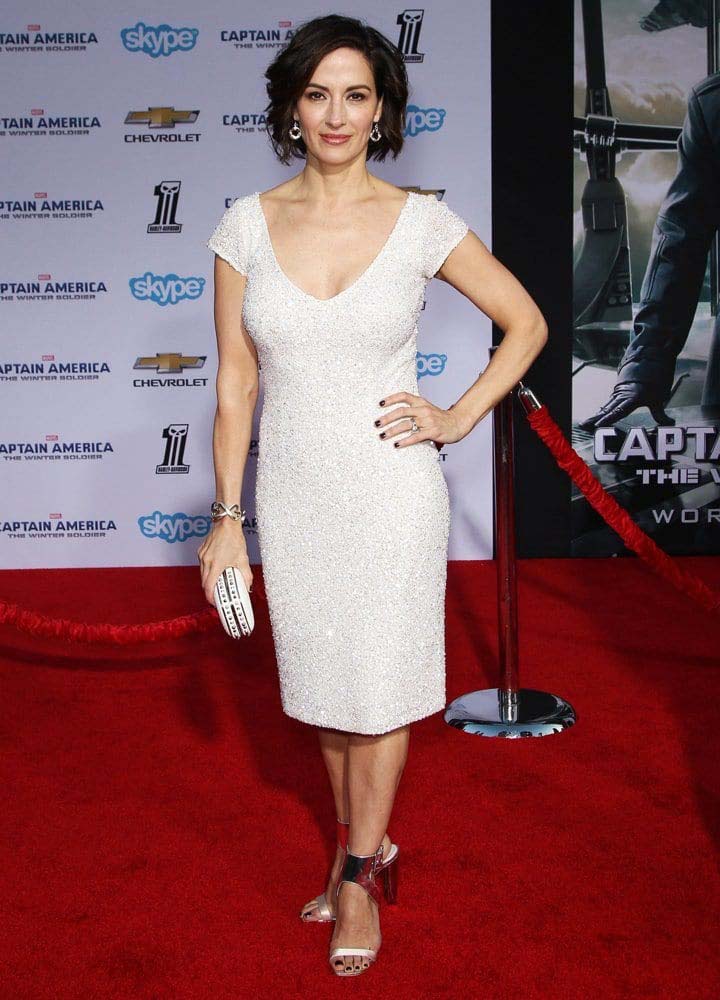

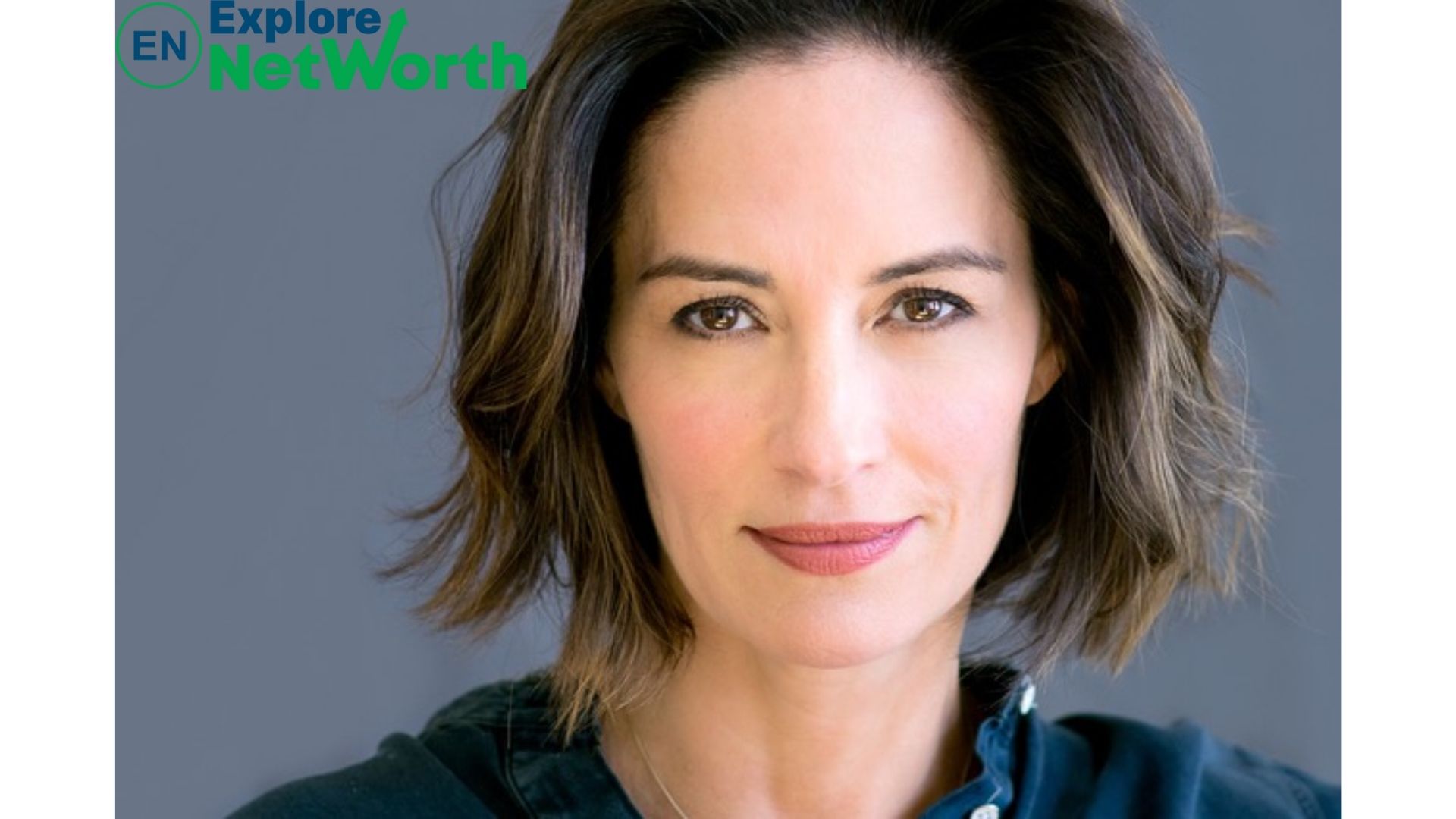

| Wendy Moniz | January 18, 1960 | Kansas City, Missouri, U.S. | Actress |

Assets

Assets are critical components of Wendy Moniz's net worth. Properties, investments, and cash represent the value of her ownership and financial holdings. These assets contribute directly to her overall financial well-being and provide a foundation for future growth.

Real estate, stocks, and bonds are examples of assets that appreciate in value over time, increasing Wendy Moniz's net worth. Cash, while not appreciating in the same way, provides liquidity and flexibility for financial transactions, investments, and expenses. By managing her assets effectively, Wendy Moniz can preserve and grow her wealth.

Understanding the connection between assets and net worth is crucial for financial planning. It enables individuals to make informed decisions about investments, savings, and spending. By focusing on acquiring and managing assets, Wendy Moniz can secure her financial future and achieve her financial goals.

Liabilities

Liabilities, encompassing debts and loans, play a significant role in shaping Wendy Moniz's net worth. Understanding these liabilities provides insights into her financial obligations and their impact on her overall financial well-being.

- Mortgages: Loans secured by real estate, typically a house or apartment, constitute a major liability for many individuals, including Wendy Moniz. Mortgage payments represent a significant monthly expense that can impact her cash flow and overall financial planning.

- Personal loans: These unsecured loans are often used for various purposes, such as consolidating debt, funding renovations, or covering unexpected expenses. Personal loans typically have higher interest rates compared to mortgages, making them a more expensive form of borrowing.

- Credit card debt: Revolving debt from credit cards can accumulate quickly, especially if not managed responsibly. High credit card balances can negatively impact Wendy Moniz's credit score and increase her overall debt burden.

- Business loans: If Wendy Moniz has invested in business ventures, she may have acquired business loans to finance operations or expansion. These loans come with specific terms and repayment schedules, which can affect her cash flow and profitability.

Managing liabilities effectively is crucial for Wendy Moniz to maintain a healthy financial position. By prioritizing debt repayment, negotiating favorable interest rates, and avoiding excessive borrowing, she can minimize the impact of liabilities on her net worth and achieve long-term financial stability.

Income

Income, encompassing earnings from acting and endorsements, stands as a cornerstone of Wendy Moniz's net worth. Her success in the entertainment industry has significantly contributed to her financial well-being and overall wealth.

- Film and Television Acting: Wendy Moniz's involvement in films and television shows has been a primary source of income throughout her career. Her notable roles in projects like "The Guardian" and "Nash Bridges" have garnered critical acclaim and commercial success, resulting in substantial earnings.

- Theater Performances: Moniz's stage performances have also contributed to her income. Her critically acclaimed work in Broadway and Off-Broadway productions has showcased her versatility as an actress and further enhanced her earning potential.

- Endorsements and Sponsorships: Moniz's popularity and public image have made her an attractive partner for brands. Endorsement deals with companies and products have provided her with additional income streams, leveraging her influence to promote various goods and services.

- Residual Income: Residuals, also known as royalties, generate ongoing income for actors based on the continued use of their work in reruns, streaming platforms, and other forms of distribution. This passive income source contributes to Moniz's long-term financial stability.

The combined income from these sources has played a vital role in building and maintaining Wendy Moniz's net worth. Her success in the entertainment industry has enabled her to accumulate wealth, invest in various assets, and secure her financial future.

Investments

Investments in stocks, bonds, and real estate represent a significant component of Wendy Moniz's net worth. These investments not only contribute to her overall wealth but also provide potential for growth and income generation, shaping her long-term financial well-being.

- Stock Market Investments: Moniz's investments in the stock market, including shares of publicly traded companies, offer the potential for capital appreciation and dividend income. By diversifying her portfolio across different sectors and industries, she can mitigate risks and maximize returns.

- Bond Investments: Bonds, issued by governments and corporations, provide fixed income payments over a specified period. Moniz's bond investments contribute to the stability of her portfolio, generating a steady stream of income and preserving capital.

- Real Estate Investments: Moniz's investments in real estate, such as residential and commercial properties, offer the potential for rental income, property appreciation, and tax benefits. By investing in tangible assets, she can diversify her portfolio and hedge against inflation.

- Alternative Investments: In addition to traditional investments, Moniz may also explore alternative investments such as private equity, hedge funds, and commodities. These investments can provide diversification and the potential for higher returns, but also carry higher risks.

Wendy Moniz's investment strategy is tailored to her individual risk tolerance and financial goals. By carefully managing her investment portfolio, she can preserve and grow her net worth, ensuring financial security for the future.

Expenses

Expenses, encompassing lifestyle costs and taxes, play a pivotal role in shaping Wendy Moniz's net worth. Understanding these expenses provides insights into her spending patterns, financial priorities, and overall financial well-being.

- Personal Expenses: Personal expenses, such as groceries, clothing, entertainment, and travel, constitute a significant portion of Wendy Moniz's lifestyle costs. These expenses reflect her personal preferences and spending habits, impacting her monthly cash flow and overall financial picture.

- Housing Costs: Housing costs, including mortgage or rent payments, property taxes, and maintenance expenses, represent a major expense category for Moniz. The location, size, and amenities of her residence influence these costs, affecting her disposable income and long-term financial planning.

- Transportation Costs: Transportation costs, encompassing car payments, insurance, fuel, and maintenance, are essential expenses for Moniz's daily life and professional commitments. The type of vehicle, driving habits, and fuel efficiency impact these costs, influencing her monthly budget and overall financial stability.

- Taxes: Taxes, including federal, state, and local income taxes, property taxes, and sales taxes, represent a significant expense category for Moniz. Effective tax planning and optimization strategies can help her minimize tax liabilities and maximize her net worth.

Wendy Moniz's expenses, both lifestyle-related and tax-related, have a direct impact on her financial well-being and long-term financial goals. By managing her expenses prudently, planning for future expenses, and seeking professional financial advice, she can optimize her financial resources and preserve her net worth.

Financial Management

Financial management is a crucial aspect of preserving and growing one's net worth. Wendy Moniz, an accomplished actress, exemplifies how effective financial management strategies can contribute to her overall financial well-being and the preservation of her net worth.

Financial management encompasses a range of strategies aimed at maximizing income, minimizing expenses, and making sound investment decisions. These strategies lay the foundation for wealth accumulation and long-term financial stability. By implementing disciplined financial management practices, individuals like Wendy Moniz can ensure that their net worth continues to grow and remains protected against unforeseen circumstances.

Real-life examples of financial management strategies that Wendy Moniz may employ include diversifying her investment portfolio, regularly reviewing and optimizing her expenses, and seeking professional financial advice to stay abreast of best practices. By managing her finances prudently, she can safeguard her wealth and achieve her long-term financial goals.

Understanding the connection between financial management and wealth preservation is essential for anyone looking to secure their financial future. Wendy Moniz's net worth serves as a testament to the power of sound financial management. By adopting effective financial management strategies, individuals can maximize their earning potential, minimize financial risks, and achieve financial independence.

Career Success

Career success plays a pivotal role in shaping an individual's net worth. In the case of Wendy Moniz, her successful career as an actress has been a primary driver of her financial well-being. The entertainment industry offers substantial earning potential, and Moniz has capitalized on her talent and dedication to build a lucrative career.

Moniz's success has enabled her to accumulate wealth through various sources, such as salaries for her acting roles, endorsement deals, and investments. Her net worth reflects the cumulative impact of her career achievements and the financial rewards that have come with them. Without her successful career, Moniz's net worth would likely be significantly lower.

Beyond the direct financial impact, career success can also positively affect an individual's net worth indirectly. For instance, a successful career can lead to increased opportunities for investment, networking, and financial advice. It can also enhance an individual's reputation and credibility, making them more attractive to potential investors and business partners.

Understanding the connection between career success and net worth is crucial for anyone looking to build wealth and secure their financial future. Wendy Moniz's career journey serves as an example of how dedication, talent, and financial acumen can combine to create substantial net worth.

Personal Factors

Exploring the personal factors that shape Wendy Moniz's net worth, it is essential to consider the role of family support and lifestyle choices. These aspects can profoundly influence an individual's financial well-being and overall success.

- Family Support: Family plays a crucial role in shaping an individual's financial habits and values. Moniz's upbringing, parental guidance, and family support system may have instilled in her a strong work ethic, financial discipline, and a sense of responsibility, contributing to her financial success.

- Lifestyle Choices: Lifestyle choices, such as spending habits, investment decisions, and career aspirations, can significantly impact net worth. Moniz's financial decisions, including her investment strategies and spending patterns, reflect her personal preferences and priorities, influencing her overall financial well-being.

- Personal Relationships: Personal relationships can influence financial decisions and access to resources. Moniz's relationships with financial advisors, mentors, and business partners may have provided her with valuable guidance, opportunities, and support, contributing to her financial growth.

- Life Events: Major life events, such as marriage, childbirth, or career transitions, can trigger financial changes. Moniz's personal life events may have impacted her financial responsibilities, expenses, and investment strategies, shaping her net worth over time.

By understanding the interplay between personal factors and net worth, we gain insights into the complex factors that contribute to an individual's financial well-being. Wendy Moniz's journey serves as a reminder that personal choices and circumstances can significantly shape financial outcomes.

In exploring the dynamics of Wendy Moniz's net worth, we have gained insights into the multifaceted factors that contribute to an individual's financial well-being. Key takeaways include the significant role of career success in generating wealth, the impact of personal factors such as family support and lifestyle choices on financial outcomes, and the importance of sound financial management for preserving and growing net worth.

These interconnected elements underscore the complexity of financial success and the need for a holistic approach to wealth creation. By understanding the interplay between these factors, individuals can make informed decisions to optimize their financial well-being and secure their financial future.

Unveiling The Legacy Of Stephanie Bolton: Vocal Powerhouse And Cultural Icon

Joe Hutto: The Ultimate Guide To His Life And Legacy

Unveiling The Journey Of Kiki Dee: A Timeless Voice

ncG1vNJzZmikmayyr7PKnmWsa16qwG7DxKyrZmpelrqixs6nmLCrXpi8rnvWnqWdsV2ivK%2B12WaqZqaVqXq4u9Gtn2egpKK5